Answer

Question: When I set up the pay periods for a Biweekly processing group the system automatically puts 27 pay periods in. Should it do this and how do I handle that in payroll?

Answer:

A year is 52.1786 weeks (not 52). Because of this the timing of bi-weekly pay periods can have 27 pay periods vs 26 pay periods in some years.

This can be an issue for salaried employees who are paid on a bi-weekly basis. Other employees will not be affected.

To set up your pay periods for the year go to Maintain>Payroll>Processing groups. Choose the group and go to the Pay Schedule Tab. Type in the new year, then fill in the first pay date. The system will automatically populate the pay dates from there.

Pay attention to see how many pay periods there are.

If there are 27 pay periods you will need to make some adjustments.

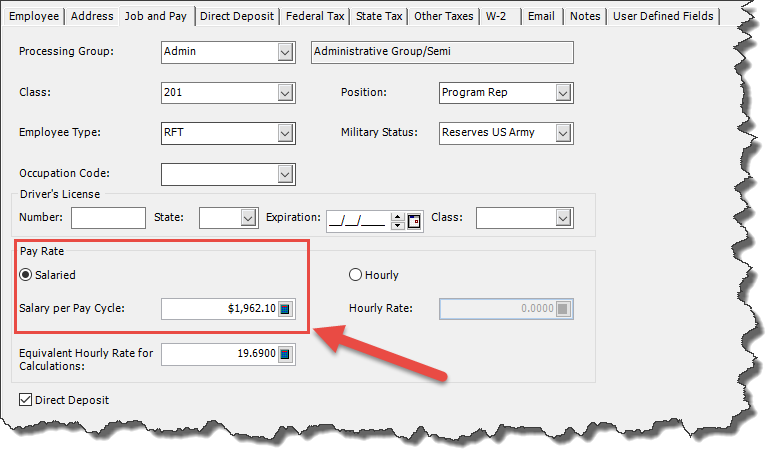

The recommended method for dealing with this exta pay period is to adjust the employes salaried amount. If you go to Maintain>Payroll>Employee Inforamtion>Job and Pay tab. Look at the Pay Rate

If the employee is salaried than you will want to adjust the salary per cycle. Take the annual pay and divide it by 27 pay periods.

For example: If a salaried employee makes $45,000 per year, they would normally receive $1,730.77 per pay period if they are bi-weekly. This would decrease to $1,666.67 per pay period.

This will be offset by the fact that they will receive an additional paycheck during the year.

It is very important to communicate this change to your employees. Otherwise when they receive their first check of the year and it is notably smaller than previous checks they will be asking why.

It is also a good idea to let them know far in advance so that they can adjust their automatic payments or other recurring bills to deal with the fact that the checks will be smaller, but they will get an extra one.

Don’t forget to pay attention to the next year, if it has 26 pay periods then you will need to change the employees salaried amounts back.

Question: Is there any way I can have the system automatically calculate the difference between the 26 and 27 pay period salary amounts and apply that without changing employee salaries?

Answer: No, the system will always take the amount per pay cycle and apply that. There is no way to modify that during the calculation.

Question: I have a lot of employees affected by this. Is there any way I can change them all at once?

Answer: If you own HR there is the Mass Update function that can allow you to change salaries based on a percentage. You would want to make sure you filter the mass update to just the employees needing adjustment. Instructions on the mass update feature can be found in this KB.

http://kb.abila.com/article/how-use-mass-update-hr-update-annual-salary#

Question: What happens if I don’t adjust my salary per pay cycle?

Answer: The employee will be paid more money over the year, an amount that will equal one paycheck.

Question: Can I modify the dates so that there are only 26 pay periods in the year.

Answer: It’s your payroll system and you can choose to modify the dates, or even not issue a final check for the extra period if you like, but it is not recommended. If you do modify the dates make sure there are no gaps between Pay Period dates (The pay period begin is always the day after the previous pay period ends). Gaps in dates will can cause a payroll to not calculate.

Question: I didn’t realize that I should reduce the amount of pay per pay period until after some checks have been cut for the new year. How do I fix this?

Answer: In this scenario you have effectively overpaid the employee. The three common ways to deal with this are:

1 – Do not pay them as much next pay period. The next pay period after you have calculated payroll go to Review/Modify Calculated Payroll and Reduce the amount of earnings by the total amounts of all the overpayments. When you save it will ask if you want to recalculate taxes. Say yes.

2 – Employee returns the overpayment. The employee returns the amount of the overpayment. The actual return of cash is handled in accounting, not payroll. In payroll you would go to Activities>Setup/Adjust Employee balances and put in negative earnings on the earnings tab. You will also need to decide how to handle the taxes. If they have less taxable income, then the amount of Taxes recorded should be reduced as well.

3- If the employee is no longer with the company and getting the money back is not an option then no further action is possible. Simply report the amount paid to the taxing authorities.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Payroll

Ranking