Answer

There may be instances when you have an invoice for a future period which must be paid in an prior period.

Some examples are rent, health insurance, etc. which must be paid prior to incurring the expense.

In order to pay that bill on time you enter the invoice in the normal fashion, but you still do not want the expenditure to reflect on your financial statement for the month for the period in which you are entering the invoice.

In order to properly account for this scenario, MIP Fund Accounting allows you to accomplish this type entry in a single document.

The simplest solution is to utilize a Prepaid type account.

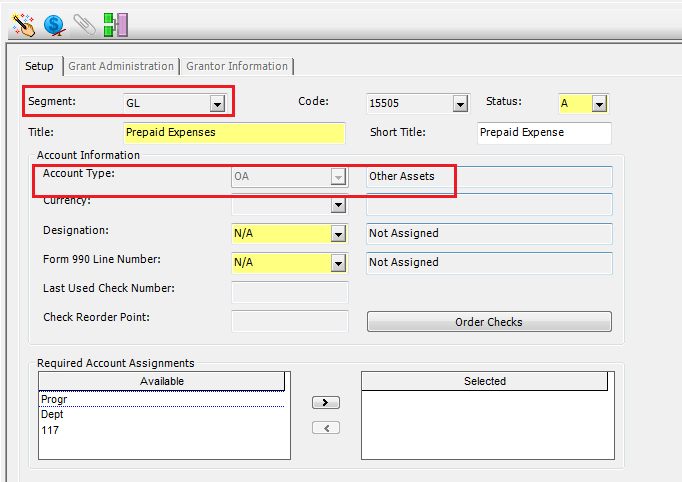

The first step in this process is to set up a Prepaid type account by navigating to: Maintain>Chart of Account Codes and establishing a Prepaid type account:

Once the Prepaid account is established, access Transactions>AP>Enter AP invoices. When entering your invoice, you will debit your Prepaid and credit your AP type accounts respectively. This ensures that the invoice date and effective date remain the same.

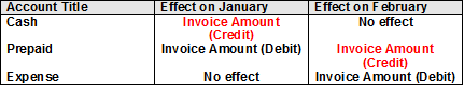

By using the same document, you can easily record the expense in the appropriate period by changing the effective date. Debit your expense type accounts and credit the prepaid type account with the effective date corresponding to the economic event. This is illustrated below:

The net effect of this transaction allows you to pay your bills in accordance to your vendors’ terms while recording your transactions according to Generally accepted accounting Principles (GAAP).

The effect on your financial statements is as follows for an expense paid in January against your cash account that will be reflected as an expense in February:

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Accounts Payable

Ranking