Answer

Question

We have an employee who receives income in the form of Tips. We have to pay Social Security and Medicare based on those tips the employee reports. How would that be recorded in MIP?

Answer

You would use a benefit code. This will increase taxable earnings without and withhold Social Security taxes without actually increasing their paycheck. However this will require adjustments when it comes time to do their W2.

Under Maintain>Benefit codes you would create a new benefit code and fill in the appropriate tax expense and liability accounts. In the W2 box you would select Box 7. The calculation method will most likely be Amount on Timesheet.

On the taxes tab you would check the taxes that are increased by their tip income (like FICA and Medicare). You would add this code to their timesheets when you process payroll. This will increase their taxable earnings for the selected taxes and withhold those taxes from their check.

When it comes time to produce the W2 in Aatrix you will get an error

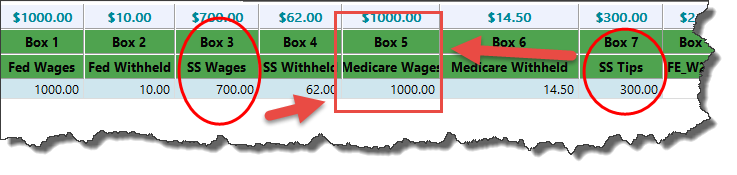

To resolve this go to the Aatrix grid for that Employee. You will notice that the amounts for regular earnings AND the benefit code are showing up in Box 3 and the amount of the benefit code is showing up in Box 7.

This means that the benefit amount is being double counted. This is because it is tagged as being subject to Social Security wages and sent to Box 7. This is unavoidable because there is no way in the system to automatically withhold Social Security taxes and not have it show up in box 3.

The solution for this is to manually reduce the amount in Box 3 by the Amount in Box 7.

When the two are added together they should equal the amount in Box 5 (unless the person earns more than the SS wage max).

After this adjustment is made you will no longer get the error.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Payroll

Ranking